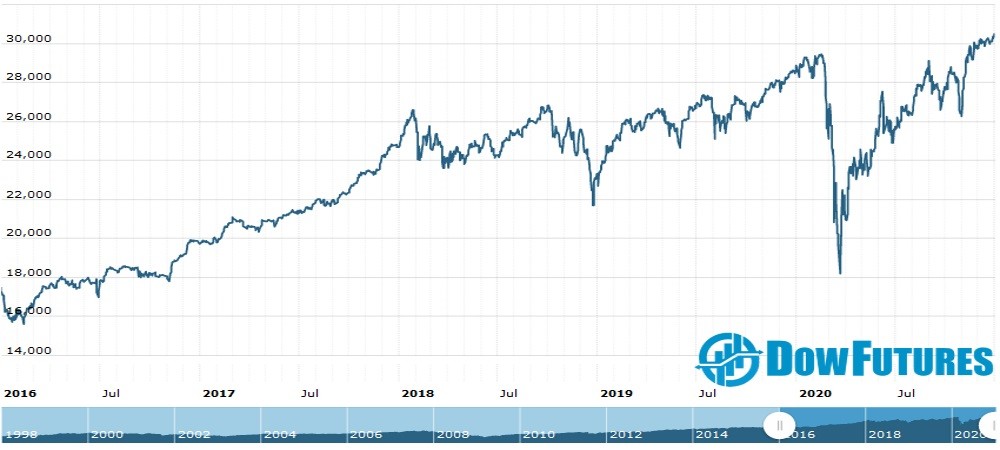

Especially since it appears to be meeting some resistance within the Federal Reserve itself.Įsther George said during her CNBC interview today: This doesn’t mean average inflation targeting will be an easy sell. Low interest rates have supported the Dow and broader stock market since the Great Recession. The Fed’s aggressive pivot toward softer monetary policy is one of the primary reasons why the S&P 500 and Nasdaq are trading at record highs and the Dow is on the verge of joining them.

That’s something investors are sure to cheer, at least in the short run. “I wouldn’t be surprised if interest rates are still zero five years from now,” said Jason Furman, a former chief White House economist and current Harvard University professor told Bloomberg. Practically speaking, this likely means that the Fed will hold interest rates near zero almost indefinitely. The Fed wouldn’t scrap the 2% target – it would just seek to average 2% inflation over the long-term rather than on a yearly basis. Rather than guard the 2% annual inflation target like a hawk, the central bank would allow it to “run hot” temporarily to stimulate economic growth and promote employment. Inflation has been so low for so long that Powell will likely advocate for “average inflation” targeting. A New Fed Policy Could Juice the Dow – But Will It Help the Economy?Īfter decades of fighting inflation, the Fed appears poised to concede that the game has changed. That makes a double-dip recession an “important risk” to her baseline outlook.Īnd it raises the stakes as Fed Chair Jerome Powell prepares to make what analysts are already calling a “historic speech” at the virtual “Jackson Hole” symposium tomorrow. Watch her remarks in the interview below: She told CNBC today that although she forecasts continued economic improvement, everything hinges on the unpredictable trajectory of the COVID-19 pandemic. In other words, the economy could briefly escape from one recession, only to stumble directly into another as growth contracts again.Ĭount Kansas City Federal Reserve President Esther George as sympathetic to the pessimists. economy will succumb to a double-dip recession. While White House adviser Larry Kudlow used his speech at the Republican National Convention to trumpet what he called a “V-shaped economic recovery,” there are escalating fears that the U.S. More Warnings About a Double-Dip Recession Nasdaq futures advanced 0.1% to 11,738.5. Dow futures are flat after the index snapped a three-day winning streak yesterday. The DJIA closed at 28,248.44 on Tuesday for a decline of more than 60 points.

Dow Futures Trade Cautiously as ‘Jackson Hole’ LoomsĪs of 8:41 am ET, Dow futures had lost 30 points or 0.11%, implying the blue-chip index will extend yesterday’s losses. The S&P 500 and Nasdaq are poised to climb to new highs, while the Dow Jones Industrial Average (DJIA) is trading narrowly in the red. stock futures diverged on Wednesday, mirroring their performance from the previous session. Fed Chair Jerome Powell has a plan – but will it be enough?.Some Federal Reserve officials are growing concerned a “double-dip” recession could batter the U.S.Dow futures traded narrowly lower on Wednesday after the index snapped a three-day winning streak on Tuesday.

0 kommentar(er)

0 kommentar(er)